According to research by WitsView, a research division of TrendForce, after the rapid growth of LCD TVs in 2006, household penetration rates in advanced countries such as Europe, North America, and Japan are approaching saturation. When the so-called CRT transition to the LCD replacement boom is coming to an end, it means that LCD TVs need more new features to attract consumers to change machines in advance. The LED backlight that has been developing for a while and the 3D that has just begun to sprout in 2010 have played such a key role.

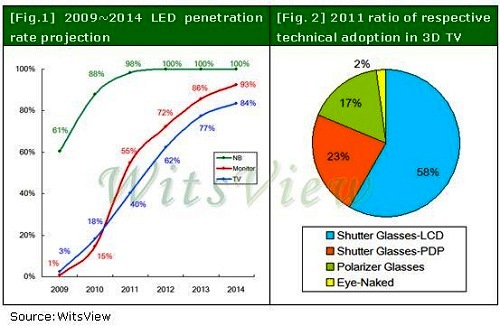

According to research by WitsView, a research division of TrendForce, after the rapid growth of LCD TVs in 2006, household penetration rates in advanced countries such as Europe, North America, and Japan are approaching saturation. When the so-called CRT transition to the LCD replacement boom is coming to an end, it means that LCD TVs need more new features to attract consumers to change machines in advance. The LED backlight that has been developing for a while and the 3D that has just begun to sprout in 2010 have played such a key role. WitsView estimates that the penetration rate of LED TVs in 2010 is about 18%, equivalent to 34 million units. However, under the effect of cost improvement, it is estimated that regardless of the price of LED backlight or LED TV panel in 2011, it will be significantly lower than in 2010, which naturally stimulates demand to take off. It is estimated that the penetration rate of LED TV in 2011 will have a chance to challenge 43%, and the number will reach 94 million.

However, whether the development of LED TVs is smooth and the supply of light guide plates is still the focus of observation in 2011. According to WitsView's research, the light guide plate material and raw material PMMA continue to expand its production capacity, with an annual growth rate of at least 17%, and some non-PMMA light guide plates have also been successively verified. In principle, the supply situation in 2011 will be slightly more relaxing than in 2010. .

However, the real problem of supply and demand for light guide plates lies in the uneven distribution of production capacity. For example, terminal sales of LED products have not been as expected in the near future. As a result, orders for light guide plates have also undergone drastic adjustments. Plate and raw material manufacturers have had to reduce their production rates. Cause irreparable loss of capacity. Once the demand for LED TV panels has warmed up since Q2 in 2011, the market may experience large growth in demand in the second half of 2011. At that time, the LGP may not be able to fully meet market demand.

3D large-size TV is another focus of attention; WitsView estimates that 3D TV penetration will increase from 1.5% in 2010 to 8.3% in 2011, and demand will grow several times from 2.7 million units in 2011. 19 million units. In the divergent 3D technology, the best performing shutter glasses type will still be in the mainstream in 2011, accounting for 81%. Due to the fast update frequency, Plasma TV (PDP) has the opportunity to follow the footsteps of 3D TV and make a comeback in this niche market. The PDP is expected to account for 28% of the 3D TV market using shutter glasses.

In other relatively niche technologies, polarized glasses are superior to shutter glasses in viewing comfort, but current products still have the limitation of halving the vertical resolution and the scarcity of supply. The estimated launch rate in 2011 is only 17%. Although naked eye 3D is the ultimate goal, the current 3D performance and the production cost of 2D/3D conversion are not ideal. It is estimated that only 2% of the market share in 2011, and the size is concentrated in 26 inches below the product.

Figure 1 LED penetration forecast for 2009~2014; Figure 2 2011 3D TV adoption