According to IHS iSuppli Corporation, competition in the form of navigation in the navigation field intensified in early 2011, sales of tablets and smartphones with integrated GPS functionality increased, and the demand for dedicated portable navigation devices (PNDs) was weakened.

According to IHS iSuppli Corporation, competition in the form of navigation in the navigation field intensified in early 2011, sales of tablets and smartphones with integrated GPS functionality increased, and the demand for dedicated portable navigation devices (PNDs) was weakened. Forms of Controversy At the 2011 Consumer Electronics Show (CES) held in Las Vegas this month, several vendors demonstrated a series of tablets that acted as mobile navigation devices. Tablets represent another class of platforms that can accommodate location based services (LBS) and navigation applications, bringing new competition to traditional PNDs.

Many navigation and LBS application vendors have begun porting iPhone iOS applications to the iPad. The graphics resolution will change and the performance will increase. Android app developers are also expected to start porting their smartphone apps to tablets. At CES, many manufacturers demonstrated how to use tablet computers as in-vehicle infotainment devices and introduced more connectivity and integration solutions.

In order to support full mobile applications such as navigation, tablet devices must support Wireless Wide Area Network (WWAN) technology (ie, 3G and 4G technologies). IHS iSuppli estimates that about 80% of media tablets currently include embedded WWAN capabilities. Most of the tablets so far have been driven by the Apple iPad. Vendors have recently launched several Android-based tablets at CES. The most prominent is the tablet PCs that Verizon has launched with its LTE network. It is expected that the dual-horse competition will be formed. To promote innovation and market acceptance. With the use of Wi-FI-only tablets and mobile hotspots, tablets that support navigation may also grow faster. But IHS iSuppli expects that vendors will be conservative in adopting this configuration.

IHS iSuppli Corporation predicts that more than 135 million smartphones sold in 2011 will have navigation capabilities. This figure may be higher than the actual number of smartphone navigation users and will increase the overall effective market (TAM) of navigation software.

In 2011, there will be more than 148 million navigation mobile phones in use globally and 269.3 million mobile phones in 2013.

Of these platform-aware navigation users, off-board navigation users accounted for about 40% in 2010, and their share will begin to decline in 2012, giving way to on-board/hybrid navigation. For mobile navigation software/services and solutions providers, Google will begin to dominate the smartphone off-board navigation market with its advertising-based business model, and Nokia's pre-installed Ovi Maps will become the leader in smartphone on-board navigation market By. At the same time, Apple’s iPhone will continue to support more and more third-party navigation application vendors.

PND is bound to decline The PND market was very hot before the economic crisis struck in early 2009. Obviously, consumers prefer a lower-cost PND solution compared to the original or aftermarket solutions installed in expensive in-vehicle factories.

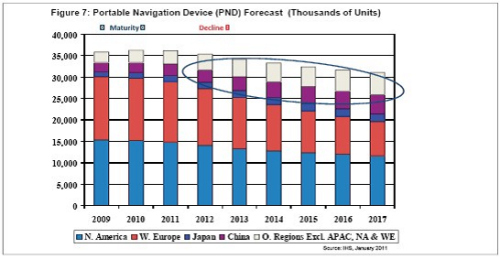

PND is currently in the mature stage of its life cycle, and will enter the recession period from 2012. It is expected that the global PND market will increase slightly by 1.2% in 2011 and reach the peak. However, starting from 2012, the global PND market will begin to shrink, although the market in China and Other regions continues to grow. These regions include Eastern Europe, Latin America, the Middle East, and Africa, as shown in Figure 7.

In 2011, the PND market will speed up the pace of integration. The two largest shipment manufacturers, TomTom and Garmin, together account for more than 60% of the global market, and account for more than 70% of the total in Europe, Middle East and Africa (EMEA). As prices become more affordable, most PND buyers in developed Western countries will purchase TomTom and Garmin products.

The impact on cars Smart phones are one of the most exciting areas in today's high-tech industries and are having a huge impact on many industries, including the information and entertainment industry in the automotive industry.

Professional devices such as PNDs are losing market share, and connected multi-functional computing platforms are becoming more and more popular, providing more ways to use the interior environment. Car manufacturers should keep pace with a large number of popular market mobile platforms and continue to strive for the compatibility of such devices with on-board systems. These consumer electronic devices can already provide users with more applications and services. In the future, the platform based on smart phones can be expanded into the hardware/software architecture of car audio bases.

Automobile manufacturers should also pay attention to business models in the field of portable device services. The subscription model faces challenges and premium services with added value are using non-traditional business models such as freemium. Many smart phone applications are adopting in-app purchases for high-end features, and free features also provide users with great value. In order to increase the return on investment of high-quality free features, it is important to figure out how to attract a significant number of users to post advertisements.

Finally, with the increasing use of mobile devices in cars, voice-driven human-machine interfaces have become more important. Bluetooth for providing service content, voice commands for onboard and off-board VR systems, and voice-to-text conversion are all technologies that automotive manufacturers must provide to meet the requirements for the use of on-board mobile devices.

Henvix Lighting Technology Co., Ltd. , http://www.sz-led-light.com